The article below is sourced from Bloomberg Wire Service. The views and opinions expressed in this story are those of the Bloomberg Wire Service and do not necessarily reflect the official policy or position of NADA.

For German luxury-car makers, being first to fail is proving valuable when it comes to electric vehicles. After a bruising initial crack at bringing EVs to market, BMW AG is lapping its rivals.

In 2008, BMW engineers set out to develop an electric city car from scratch. Five years later, the company introduced the i3, a quirky four-seater with rear-hinged back doors and a frame made with carbon fiber. The car looked unlike anything else in its portfolio, but with its steep sticker price and limited range, sales were muted. Disillusioned, BMW slowed its EV plans.

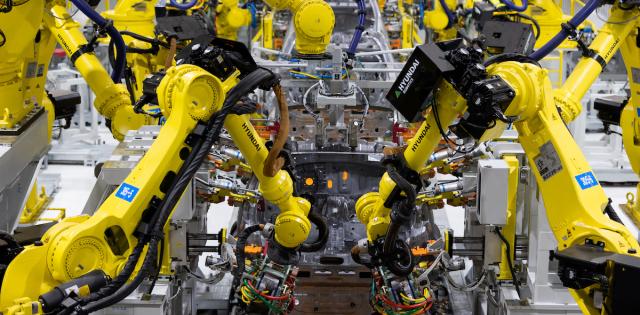

Years spent soul-searching led to criticism that BMW was stalling on EVs. Lately, though, the company has been hitting the right notes with a much less radical approach. It designed EVs almost indistinguishable from their combustion engine-powered siblings, and is building them on the same factory line to contain costs.

The approach is paying dividends: BMW shipped more than twice as many EVs than Audi in the first quarter, and roughly two-thirds more than Mercedes-Benz Group AG.

“BMW has been able to adapt its over one decade worth of battery-electric vehicle knowledge into its current model lineup with almost zero handicap,” said Matthias Schmidt, an independent auto analyst near Hamburg. “They have carried the Ultimate Driving Machine mantra over to their EVs.”

BMW’s success is all the more impressive since it coincides with a broader slowdown in demand for EVs, particularly in Europe, where governments are reducing subsidies. Mercedes cited the phase-out of its Smart Fortwo two-seater and sluggish demand in Germany for falling EV wholesales in the first quarter. Earlier this month, Tesla Inc. reported its first year-on-year global sales drop since 2020.

Some of BMW’s head start has to do with its rivals veering off course. Volkswagen AG’s Audi has been falling behind in China, its biggest market, after failing to offer models that cater to local tastes. Software issues delayed one of its key battery models, the mid-size Q6 e-tron SUV, by two years.

Mercedes’s push further upmarket has been complicated by poor uptake of its top-end electric model, the €110,000 ($117,000) EQS sedan, which has been criticized for its low-slung roofline that crimps head- and legroom in the back. That’s a no-go, especially in China, where many buyers prefer to be chauffeured. The manufacturer slashed the price of the EQS and has unveiled a redesigned version with more spacious “executive” rear seating, but the update won’t reach customers in China until the fourth quarter.

BMW’s EV lineup is fresher and more attractive, said Metzler analyst Pal Skirta. It ranges from the compact iX1 SUV to the i7 luxury sedan, which comes with options including massage seats and a large video screen that folds down from the ceiling.

To be sure, BMW is facing intense competition in China, where local automakers including BYD Co. are pushing into the luxury segment. In Europe, BMW is offering the steepest rebates for premium EVs, according to Bloomberg Intelligence analyst Michael Dean, meaning its volume push risks eroding profitability. Both Mercedes and Audi are working on new products to be introduced from next year that are bound to shake up the competitive landscape.

Still, Chief Executive Officer Oliver Zipse has made some decisions that currently are giving the Munich-based automaker a leg up. Instead of investing billions in its own battery factories, BMW is sourcing cells from external suppliers including China’s CATL, allowing the carmaker to respond flexibly to swings in demand. Its work on autonomous-driving technology and in-car software catered to Chinese customers bolstered its technology credentials in the biggest auto market, Skirta said.

For its next iteration of EVs, BMW will go back to the future with a more radical redesign — maybe not as drastic as what the i3 tried to do, but one that could change the dynamics yet again. Its Neue Klasse SUV concept unveiled last month previewed a less cluttered interior, with key driver information projected at the base of the windshield.

“For the Neue Klasse design, BMW really focused on an interior that is more of a living environment,” Skirta said. “This will be a selling point especially in China, where customers spend several hours a day in their cars.”

For more stories like this, bookmark www.NADAheadlines.org as a favorite in the browser of your choice and subscribe to our newsletter here: